News

Life is unpredictable but as an individual, you shouldn't be unpredictable for your financial planning.

Life is unpredictable but as an individual, you shouldn't be unpredictable for your financial planning.

People know how to earn money but they don't know to multiply that eraned money and that's why they face financial crisis.

Proper investment at the right time in the right asset will help you to be financial crisis-free throughout your life if proper investment is done. If you don't how to start than the best option to start is investing in mutual funds and follow a systematic investment plan while investing in mutual funds.

Here is an example of how mutual funds work and you will not be burdened by loans.

Suppose you have home loan of 20,00,000 at a rate of interest of 9% for 20 years time period.

So net repayment you have to do is RS 43,18,685 at an EMI of 17,995Rs.

Now at the same time if you invest 1/3rd of your EMI i.e. 5000Rs in mutual funds on a monthly basis you will get 45,99,287 Rs at an interest rate of 12% compounded annually.

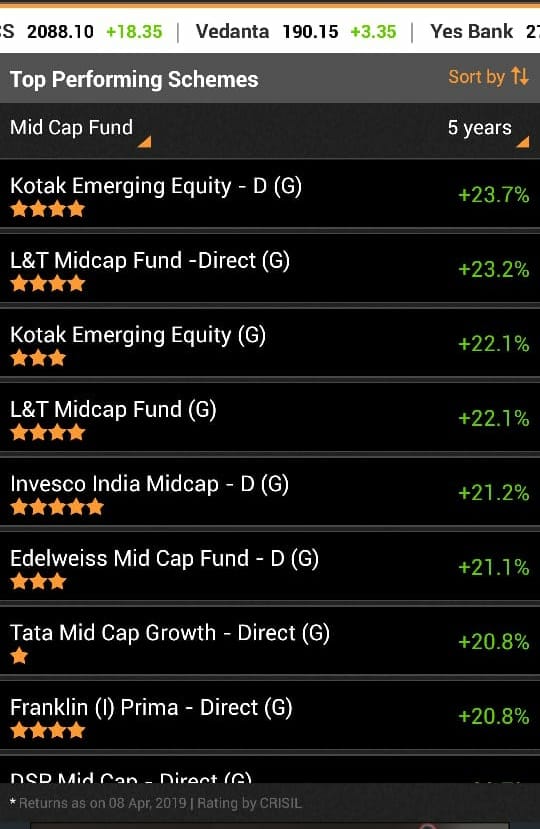

Because seeing the records of the last 15 years in mutual funds the minimum return on majority of mutual fund is 12%.

So start investing in mutual funds by following a systematic investment plan